Just what it says — that our employees are the owners of KE&G Construction. All full-time employees have a direct path to ownership of company stock at no cost to them. 100% of our stock is held by employees and that sets us apart (only about 1 out of 200 businesses in America can say that).

KE&G ESOP is a company funded retirement plan that purchases KE&G Construction, Inc. stock for eligible employees at NO cost to the employees. In 2006 the KE&G ESOP was formed, and the KE&G Owners sold 49% ownership of KE&G’s capital stock to the KE&G ESOP. This purchase was made possible with a contribution of approximately 45% of the purchase price and a loan from KE&G Construction, Inc. to the KE&G ESOP. The contribution was a gift to the ESOP from the company, and the first loan was repaid from the ESOP’s share of company profits in 2014. In June 2014, the company purchased the remaining 51% of stock from the original owners who retired in 2014. We are now a 100% employee owned company.

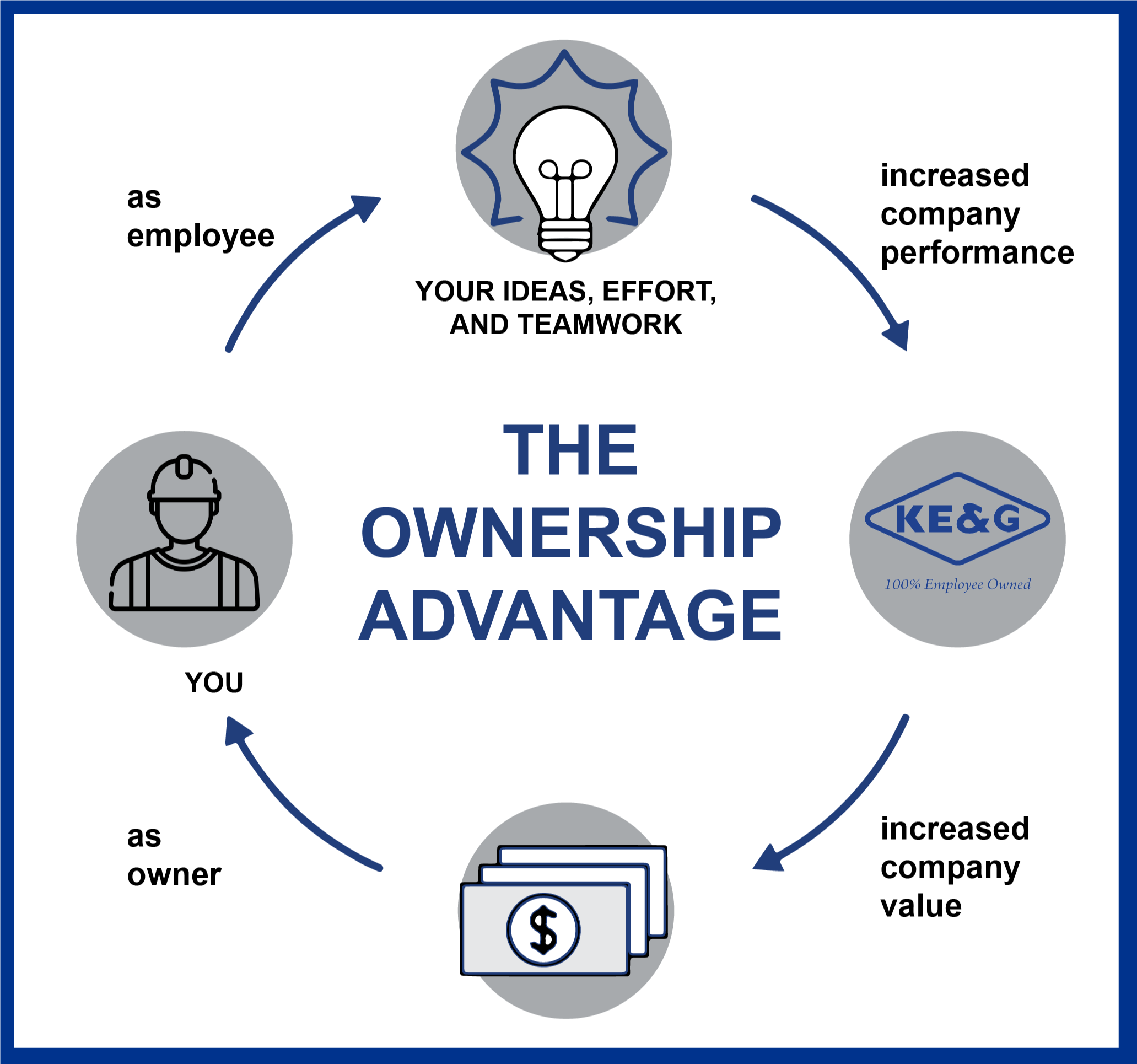

Employee ownership closes the loop between the company’s success and your financial success. As an employee, you contribute your ideas, effort, and teamwork. Your work, combined with the work of your fellow employee owners, drives better company performance. This increases the value of our business, which flows back to you as an owner in the form of shares and ultimately dollars in the bank.

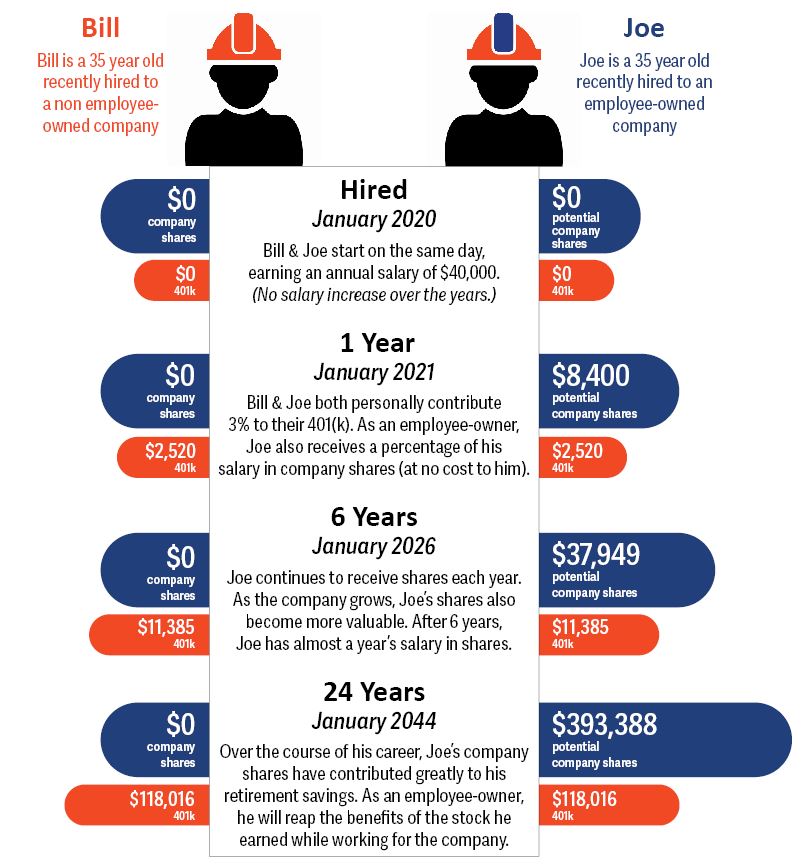

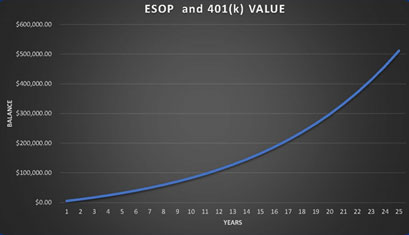

Employee ownership is about long-term wealth building. We can’t make you rich overnight, but if you make a commitment to KE&G, employee ownership ensures that our success is your success. Though the future is uncertain, this graph shows a possible outcome for an employee with what management believes are reasonable assumptions about our future performance. We can’t promise these results, but we can offer you what is possible.

DISCLAIMER – This infographic is solely for illustrative purposes and should not be relied upon in any way and should not be legal, financial, tax, or other professional advice. KE&G does not promise or guarantee the accuracy of the results or the relevance of their specific circumstances.

This document is merely a representation of the Summary Plan Description. It is strongly recommended that you read and understand the KE & G ESOP Summary Plan Description provided to you when you first become a KE & G employee.

The Summary Plan Description summarizes the main provisions of the Plan. It is not the complete Plan. A complete copy of the Plan can be obtained by following the directions in the section of the Summary Plan Description entitled “Statement of ERISA Rights,” in case of any conflict between the provisions of the complete Plan and this document, the provisions of the complete Plan will control. Please note that the Plan Committee has final and exclusive authority to decide all questions arising in connection with the Plan.

KE&G is a respected 100% employee-owned company that is committed to delivering safe, high-quality projects that exceed the expectations of our clients